Risika score and creditworthiness

This article explains the difference between the Risika Score and the Credit Score.

We get a lot of enquiries asking about the Risika Score and the creditworthiness displayed on the platform. This article can therefore help you understand the difference between the two and how they are calculated.

Overview

1. Risika Scores2. Creditworthiness

3. Difference between Risika Score and Credit Rating

NB: Both the Risika score and the credit rating are calculated by Risika.

Risika Scores

The Risika score is an assessment of the probability of the company going bankrupt.

The Risika score is therefore a separate issue to the actual assessment of the creditworthiness of a company.

The score is calculated using an "intelligent scorecard model" that classifies all companies into risk groups 1 - 10 based on a number of industry-adjusted financial ratios, company age, statement type, related bankruptcies, foreclosures and the industry the company is in.

Accounting and other variables included in the model are net income, EBITDA, EBIT, financial expenses, current assets, balance sheet, debt, equity, currency, legal form, date of incorporation, statement type and industry.

| Risika score |

Risk |

|

1-3 |

High |

| 4-6 | Medium |

| 7-10 | Low |

Creditworthiness

Creditworthiness on the Risika platform is displayed as "Credit Maximum" and "Credit Days". These are calculated by looking at the size of the company's equity.

It is therefore possible that a company with a Risika Score of 5 will have a higher maximum credit score than a company with a Risika Score of 7.

Holding companies' credit limits are calculated on the basis of their equity capital, which also takes account of shareholdings, minority interests, intangible assets, cash and cash equivalents and receivables from affiliated undertakings.

Credit limit

Risika never recommends more than DKK 25 million in credit max.

Holding: Risika never recommends over DKK 15m in credit max.

Credit days

Risika never recommends more than 90 credit days.

The difference between Risika Score and Creditworthiness

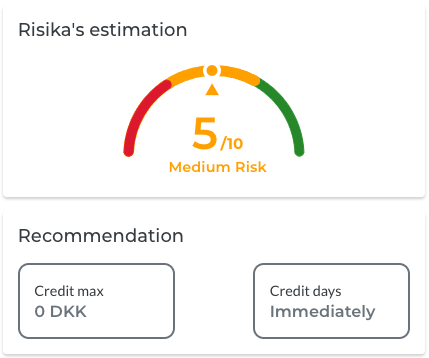

In the example below, you can see what the difference could potentially look like for a company. In this example, the company scores 5 in Risika Score, while it is recommended that they get no credit.

They have a very low credit rating, due to negative equity.

However, they score 5, which means that there is only a medium risk of them going bankrupt.

So even though the risk is medium, it is not recommended that you give this company credit.