Credit policy setup

In this article, you will be presented with how to set up the simple and the advanced credit policy and how to use it in your everyday life.

You can use your credit policy in several ways. You can use it actively to show which companies you can give credit to and which may have to pay up-front.

You can also choose to say that if a business is approved by your credit policy, you can give them more credit than Risika recommends. Here, for example, we have customers who multiply the credit card by x1.5.

The article is divided into 3 parts:

Simple credit policy

Advanced credit policy

How your credit policy is reflected on the Risika platform

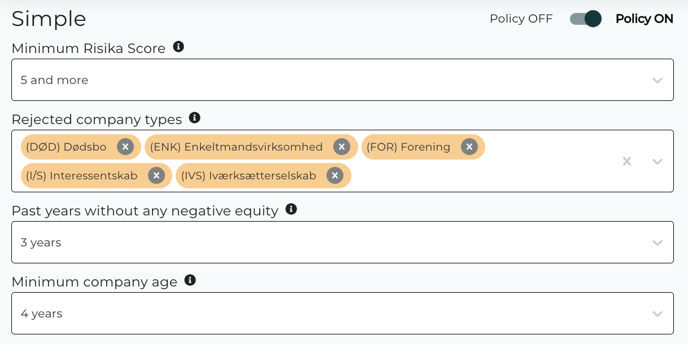

Simple credit policy

Minimum Risika Score

Here you can choose how low the Risika score must be before you can give them credit.

Rejected company types

Here you have the option to sort out company types - this could be, for example, sole traders who do not provide accounts. Unsorted companies will still appear on the platform, but will simply be rejected by your credit policy.

Past years without any negative equity

Here you can choose if you can give credit to companies that have negative equity and how long they have had it.

Minimum company age

Here you can choose whether to give credit to young companies based on their age.

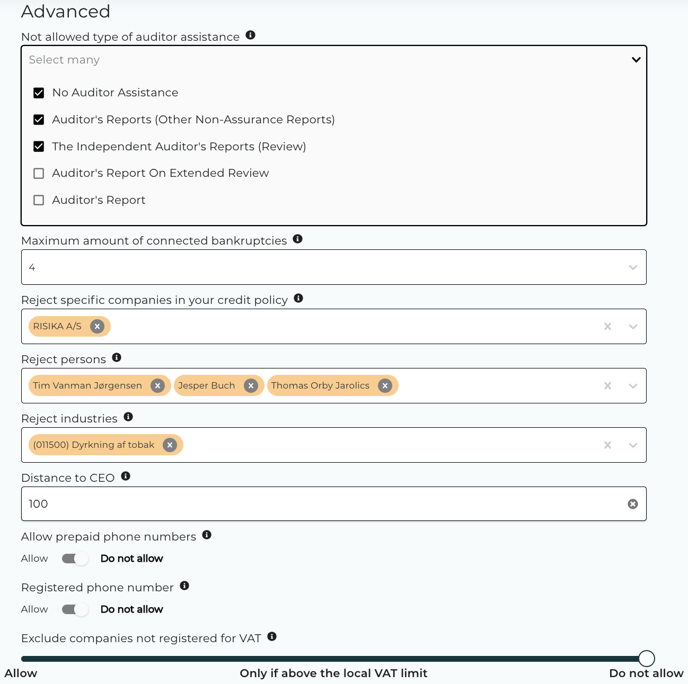

Advanced credit policy

Not allowed type of auditor assistance

Here you have the option to deselect the different statement types found on the financial statements.

Maximum amount of connected bankruptcies

Here you have the option to select how many related bankruptcies the management and board of directors have behind them. This is measured by the number of companies the board and management have been in that have previously gone bankrupt.

Reject specific companies in your credit policy

Here you have the option to de-sort companies. This may be companies you have previously experienced have not paid their bills on time.

Reject persons

Here you have the possibility to unsort specific persons. If the person joins a new company, this will be picked up by the credit policy as it looks at the individual's relationships with the companies he or she is active in.

Reject industries

Here you have the option to unsort industries you do not want to give credit.

Distance to CEO

We have found that the greater the distance from the company address to the CEO address, the greater the risk of fraud. This is in particular with regard to shell companies. You therefore have the option to enter how far the distance between the company address and the CEO address may be.

Allow prepaid phone numbers

Here you can choose whether to allow companies that have registered a voice time card with the CVR. Usually when there is a voice time card registered, it can be an indicator of fraud.

Registered phone number

Select if you will allow companies that have registered a phone number to their company. The phone number is the publicly available number for the company.

Exclude companies not registered for VAT

Option to select which type of VAT limit the company must comply to before giving credit.

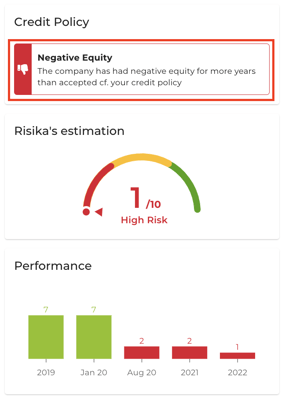

How your credit policy is reflected on the Risika platform

After you have set up your credit policy, it will appear in 2 places. It will appear in "Credit Check" and "Monitoring".

Credit check

As illustrated in the picture, we can see here that the company has been rejected according to the credit policy that we have established. Here the company has been rejected because it has had negative equity for more years than it is accepted.

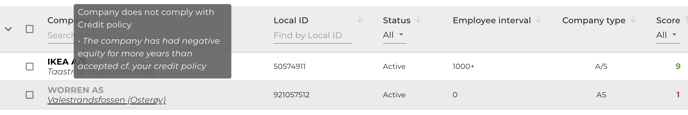

Monitoring

If there are companies on your monitoring list that do not comply with your credit policy, the text will change to light grey, rather than the normal black as we can see in the example above.

If you hover over the company name, it will show why the company does not comply with your credit policy. Here we can see that the company doesn't comply with the credit policy because there have been too many years of negative equity.