Credit automator

Credit Automator automates your credit policy with tailored credit recommendations of your own choice.

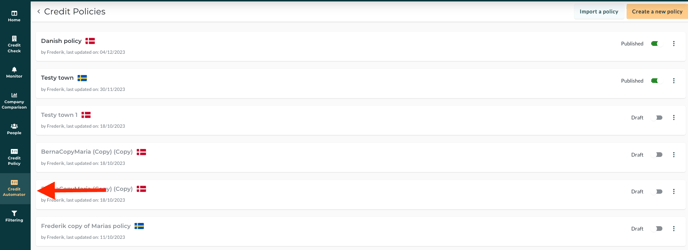

Overview

- Build a credit policy

- The three outcomes

- Rejected credit

- Manual review

- Approved credit

- The finished credit policy

- Results on the companies

You'll find the Credit Automator feature on the left side of the platform, just above Filtering.

Build a credit policy

When you're about to build your credit policy, simply click on the yellow button in the top right corner.

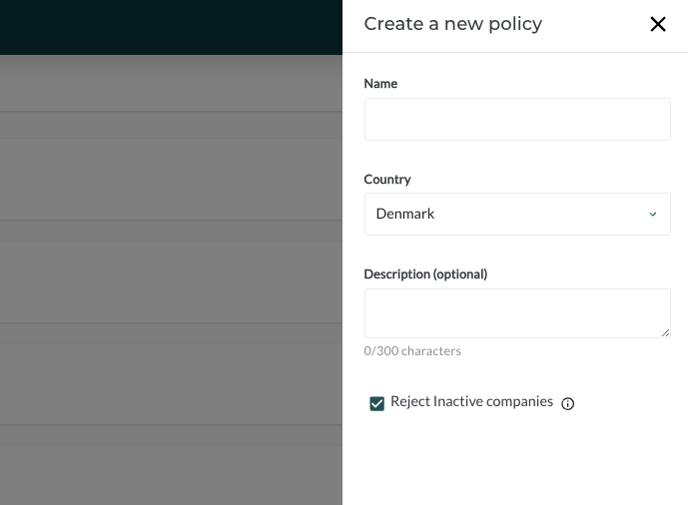

Next, you should name your credit policy and choose the country it should apply to. You have the option to add an explanation and choose whether the policy should automatically reject inactive companies from the start.

You can create a credit policy for: Denmark, Sweden, Norway, and Finland.

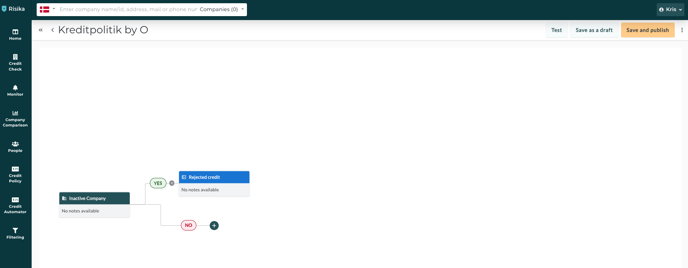

Now you can start building your credit policy.

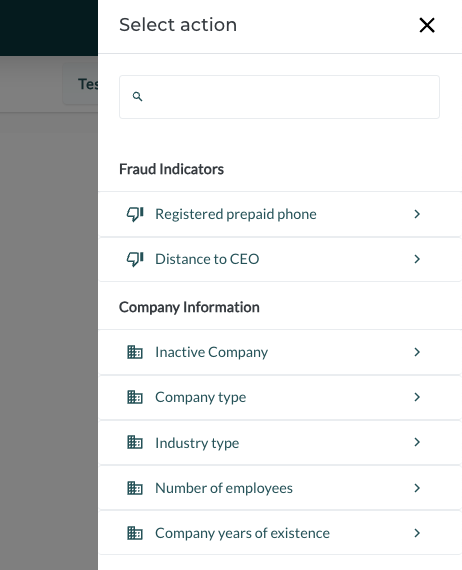

Here, you just click on the small "+" icon, which will take you to where you can choose which rules you want to add.

There is a long list of rules that you can add to your credit policy. Some of these include:

- Company type

- Industry type

- Number of employees

- Risika score

- Equity

- Blacklisted companies or individuals

- Company age

Note: There may be specific rules that apply to specific countries. For example, Denmark has audit levels, related bankruptcies, and prepaid cards, whereas Norway, for example, has payment remarks.

You can find all the different rules when you start building your credit policy.

The three outcomes

There are three outcomes, or results, that you can include in your credit policy:

- Reject credit

- Manual review

- Approve credit

Reject credit

With this outcome, you reject that companies that match these rules are not allowed to get credit from you.

Manual review

Manual review allows you to check a company manually before granting credit. It could be that a seller wants to sell to a company where this outcome clearly indicates that the company should be manually checked before the credit is granted.

Approve credit

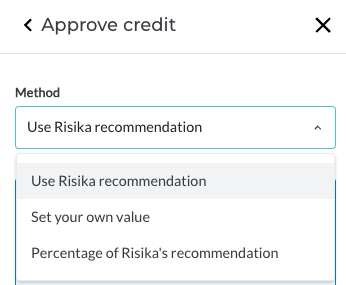

You have several options for your credit granting - Use Risika's recommendation, use a percentage of Risika's recommendation, and set your own credits.

The finished credit policy

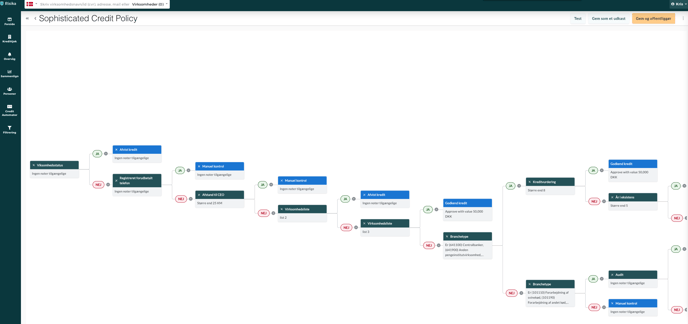

It can be relatively simple with a few rules or very complex. It's entirely up to you and your company's internal rules and policies.

A credit policy could look like this:

When you're done with your credit policy, it needs to be published, which means it will be active on your platform. You can do this by clicking on the yellow button in the top right corner.

Here, you also have the option to:

Test - Test your credit policy on a list of companies

Save as draft - Save the policy without publishing it

Three dots - Here you can export your policy, change settings, duplicate it, and delete it.

Results on the companies

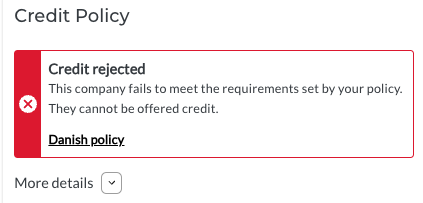

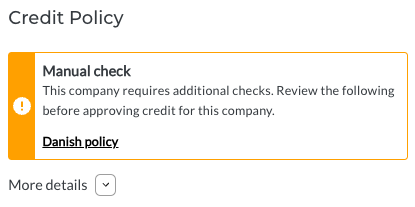

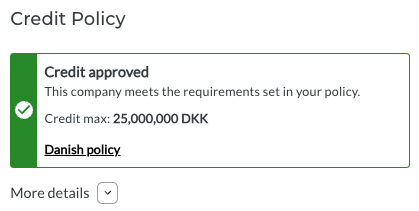

Here you can see examples of how the credit policy reflects on the credit check page, based on the three different outcomes.

Rejected credit

Manual review

Approved credit

Need help?

If you have any questions about the integration or if there's anything else we can assist you with, please don't hesitate to contact us. You can reach us at support@risika.com or by using the live chat on our website.